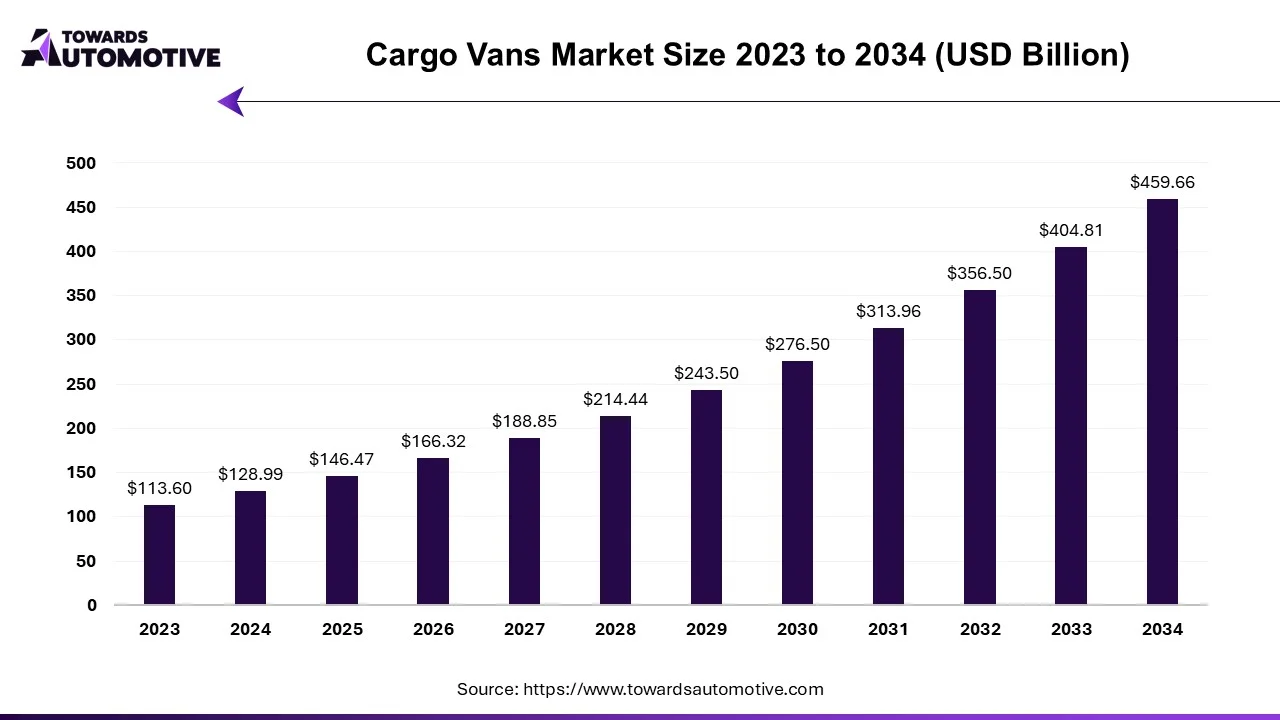

Cargo Vans Market Size Worth USD 459.66 Bn by 2034

According to a recent analysis by Towards Automotive, the global cargo vans market is projected to expand from USD 166.32 billion in 2026 to USD 459.66 billion by 2034, recording a CAGR of 13.55% between 2025 and 2034.

Ottawa, Oct. 22, 2025 (GLOBE NEWSWIRE) -- The global cargo vans market reported a value of USD 146.47 billion in 2025, and according to estimates, it will reach USD 459.66 billion by 2034, as outlined in a study from Towards Automotive, a sister firm of Precedence Research.

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Key Takeaways

- By propulsion, the diesel segment dominated the market in 2024.

- By propulsion, the electric segment is expected to grow the fastest.

- By tonnage capacity, the 2 to 3 tons segment led the market this year.

- By tonnage capacity, the less than 2 tons segment is seen to have the fastest growth.

- By end use, the commercial segment held the largest market share.

- By end use, the personal use segment is expected to grow the fastest as of this year.

- By region, North America dominated the market in 2024.

- By region, Europe is expected to grow at the fastest rate throughout the forecast period.

What are Cargo Vans?

Cargo vans are vehicles that play an important role in transporting tools, materials and equipment to job sites, particularly in residential and light commercial construction projects where larger trucks may face limitations. The cargo vans market is projected to experience steady growth in the coming years. This growth will be driven by rising demand for efficient transportation solutions for logistics and e-commerce operations.

Additionally, technological advancements such as autonomous driving are also creating new opportunities for enhanced safety and efficiency in cargo van operations. Manufacturers are focusing on developing vehicles that have an increased payload capacity, fuel efficiency and advanced safety features. Additionally, partnerships with logistics and e-commerce companies to provide integrated solutions are also on the rise, propelling the market forward.

All the Stats, Charts & Insights You Need - Get the Databook Now: https://www.towardsautomotive.com/download-sample/1222

Market Trends

- The rapid expansion of the global e-commerce sector has led to a surge in the demand for cargo vans, especially when it comes to last-mile delivery operations. As online shopping continues to grow popular, logistics and delivery providers are increasingly looking for vehicles that can offer quick and dependable service.

- The global shift toward electrification is creating substantial growth opportunities worldwide, fueled by rising environmental awareness and stricter emission regulations.

- The market is also witnessing a rise of small and medium-sized enterprises (SMEs). As more entrepreneurs enter the market and establish logistics companies or delivery services, the demand for cargo vans is set to increase

Market Dynamics

Driver

Rise of the E-Commerce Industry

One of the primary drivers in the cargo van market is the rise in e-commerce activities worldwide. As online retail giants and local businesses enhance their services to meet consumer expectations for faster deliveries, the demand for reliable, flexible and efficient transportation solutions has also increased.

Cargo vans offer optimal balance of payload capacity and maneuverability, and are thus, increasingly favored for last-mile delivery operations, especially in congested urban environments. The rise of concepts such as same-day and next-day delivery services has further amplified the need for robust cargo vans, pushing logistics providers and manufacturers to expand and modernize their vehicle inventories.

Additionally, the integration of telematics and fleet management technologies has also enhanced operational efficiency, helping companies to monitor vehicle performance, optimize routes and reduce delivery times, thus reinforcing the cargo van markets position even more.

Restraint

High Upfront Investments

Despite promising growth prospects, the market does have its fair share of challenges. Cargo van ownerships usually involve substantial upfront investments. This can restrict market access for small scale businesses and individual operators. New cargo vans typically cost a lot, depending on size, features and fuel type, representing significant capital requirements for small enterprises.

Maintenance expenses further add to ownership costs, particularly for high-mileage commercial applications. Insurance costs for commercial vehicles can also exceed passenger car rates due to their higher liability exposure. These financial barriers can limit market participation and slow adoption rates among potential users, thus creating a hinderance for market growth and development.

Opportunity

Urbanization and Technological Advancements

Urbanization and infrastructure development are introducing new opportunities in the cargo van market, fueling its expansion. With the world’s urban population steadily increasing, there is a growing need for efficient goods movement within the city. Cargo vans, especially light-duty models, are ideally suited for navigating narrow streets and accessing urban delivery points that are often inaccessible for larger trucks.

Governments and city planners are also actively investing in smart city logistics hubs and dedicated delivery zones, giving way for smoother and more organized cargo van operations. These urban trends coupled with the ongoing digital transformation in transportation and logistics are reshaping the market landscape, fostering innovation in vehicle design, connectivity as well as operational flexibility.

Innovations such as telematics, route optimization software and advanced safety features are also helping to enhance the efficiency and safety of cargo van operations. These technologies enable fleet managers to monitor vehicle performance, reduce operational costs and improve delivery times. As businesses seek to optimize their logistics processes, the adoption of technologically advanced cargo vans is likely to increase even further.

More Insights of Towards Automotive:

- Chartered Air Transport Market Size, Competitive Analysis, Value Chain & Trade Analysis 2025-2034 - The chartered air transport market is forecasted to expand from USD 67.5 billion in 2025 to USD 125.68 billion by 2034.

- Europe Automotive Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034 - The Europe automotive market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- Sustainable Automotive Manufacturing Market Size, Segments, Regional Data (NA/EU/APAC/LA/MEA), Companies, Competitive Analysis, Value Chain & Trade, 2025-2034 - The sustainable automotive manufacturing market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- Wireless Charging Electric Vehicle Market Size, Segments, Regional Data (NA EU APAC LA MEA), Companies, Competitive Analysis, Value Chain and Trade, 2025–2034 - The wireless charging electric vehicle market is anticipated to grow from USD 457.14 million in 2025 to USD 3,433.07 million by 2034.

- Automotive Telematics System Market Size, Segments, Regional Data (NA EU APAC LA MEA), Companies, Competitive Analysis, Value Chain and Trade, 2025 to 2034 - The automotive telematics system market is projected to grow from USD 35.51 billion in 2025 to USD 54.43 billion by 2034 at a CAGR of 5.04 percent.

- Automotive Camera Market Size, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Companies, Competitive and Value Chain Analysis - The automotive camera market is projected to grow from USD 14.32 million in 2025 to USD 38.11 million by 2034.

- End-to-End (E2E) ADAS Market Size, Segments, Regional Data (NA/EU/APAC/LA/MEA), Companies, Competitive Analysis, Value Chain & Trade, 2025-2034 - The end-to-end (E2E) ADAS market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034.

- Asia Pacific Automotive Brake Market Research, Trends and Forecast - The Asia Pacific automotive brake market is expected to increase from USD 53.21 billion in 2025 to USD 86.37 billion by 2034.

- Automotive Disc Brake Market Key Trends, Disruptions & Strategic Imperatives - The automotive disc brake market is forecast to grow from USD 18.39 billion in 2025 to USD 33.37 billion by 2034, driven by a CAGR of 6.93% from 2025 to 2034.

- Marine Port Services Market Strategic Analysis and Growth Opportunities - The marine port services market is forecasted to expand from USD 64.62 billion in 2025 to USD 93.02 billion by 2034, growing at a CAGR of 4.13% from 2025 to 2034.

- Motorsport Market Outlook Scenario Planning and Strategic Insights for 2034 - The motorsport market is projected to reach USD 20.75 billion by 2034, growing from USD 10.32 billion in 2025, at a CAGR of 8.13%.

- HD Maps for Autonomous Vehicles Market Size, Key Trends, Innovations & Market Dynamics - The HD maps for autonomous vehicles market is forecast to grow from USD 3.13 billion in 2025 to USD 21.49 billion by 2034.

- Class 8 Truck Market Intelligence Report, Key Trends, Innovations and Dynamics - The class 8 truck market is set to grow from USD 96.69 billion in 2025 to USD 146.56 billion by 2034, with an expected CAGR of 6.93% over the forecast period from 2025 to 2034.

- Heavy-Duty Autonomous Vehicle Market Strategic Analysis & Growth Opportunities - The heavy-duty autonomous vehicle market is forecasted to expand from USD 50.11 billion in 2025 to USD 167.25 billion by 2034.

- Hypoid Gearbox Market Key Trends, Disruptions and Strategic Imperatives - The hypoid gearbox market is expected to grow from USD 3.46 billion in 2025 to USD 5.62 billion by 2034, with a CAGR of 5.53%.

- Integrated Bridge Systems Market Growth Drivers, Challenges and Opportunities - The integrated bridge systems market is projected to reach USD 11.54 billion by 2034, growing from USD 8.67 billion in 2025, at a CAGR of 3.23%.

- Marine Steering System Market Growth Drivers, Challenges and Opportunities - The marine steering system market is forecasted to expand from USD 3.65 billion in 2025 to USD 5.09 billion by 2034, growing at a CAGR of 3.76%.

- Automotive Planetary Gear Market Growth Drivers, Challenges and Opportunities - The automotive planetary gear market is forecasted to expand from USD 5.05 billion in 2025 to USD 8.20 billion by 2034, growing at a CAGR of 5.54%.

- Automotive Worm Gears Market Playbook, Growth Opportunities and Trends by 2034 - The automotive worm gears market is set to grow from USD 2.38 billion in 2025 to USD 3.93 billion by 2034.

- Boat and Ship Telematics Market Outlook Scenario Planning & Strategic Insights for 2034 - The boat and ship telematics market is projected to reach USD 7.33 billion by 2034, expanding from USD 3.18 billion in 2025.

Regional Analysis

Why is North America dominating the market?

North America dominated the market in 2024. This is due to their extensive e-commerce infrastructure, established commercial vehicle manufacturing and strong small business sectors. The region also boasts a mature logistical network and rapid delivery services, driving consistent demand for urban delivery solutions. High adoption of advanced vehicle technologies and substantial fleet replacement cycles further boost the region’s market growth.

U.S Market Drivers:

- The growing preference for customized cargo vans tailored to specific business needs in the region has led to increased demand for modular and upfitted van designs.

- The rise of subscription-based vehicle leasing and rental services has also made cargo vans more accessible to businesses that require flexible fleet options without the need for significant capital investment.

- The country’s healthcare transportation domain is opting for specialized cargo vans equipped with refrigeration units, shelving systems and temperature-controlled compartments in order to enhance operational efficiency.

- The country has also witnessed the growth of urban logistics, which helps to propel the market forward.

What are the advancements in Europe?

Europe is seen to have the fastest growth throughout the forecast period, driven by stringent environmental regulations, dense urban populations and advanced logistics infrastructure. The European Union's Green Deal further mandates significant emissions reductions, accelerating electric vehicle adoption across various commercial segments. High fuel costs and urban access restrictions further help to incentivize efficient, clean vehicle technologies, propelling the market forward.

Germany Market Drivers:

- German cargo van manufacturers are increasingly focusing on customizable and modular designs to help meet diverse industry needs, including last-mile delivery and specialized services.

- Platforms are being developed for applications such as refrigerated transport and mobile workshops, supported by advanced techniques like 3D printing and flexible production lines.

- Fleet operators in the country are increasingly adopting electric solutions due to government incentives as well as the EU Green Deal.

- The country is also witnessing a rapid expansion of charging infrastructure, which is accelerating commercial adoption.

Elevate your automotive strategy with Towards Automotive. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardsautomotive.com/schedule-meeting

Segmental Analysis

Propulsion Insights

Which propulsion segment dominated the market in 2024?

Diesel-powered cargo vans dominated the market in 2024. These types of vans are valued for their superior torque, fuel efficiency and durability in demanding applications. Diesel engines are particularly favored in heavy-duty and long-haul operations, where payload capacity and range are a priority. The advantage of this segment lies in the fact that it is highly cost-effective, reliable and is freely available in developing regions.

The electric cargo van segment is experiencing the fastest growth, driven by the global push towards decarbonization and sustainable transportation. Electric vans offer zero emissions, lower operating costs and reduced noise pollution, making them ideal for urban and last-mile delivery applications. Major global manufacturers are investing heavily in the development of electric van platforms, introducing models with extended range, fast-charging capabilities and advanced connectivity features.

Tonnage Capacity Insights

Which tonnage capacity held the largest market share?

The 2 to 3 tons tonnage capacity segment held the largest share of the market this year. This dominance is being driven by the segment’s optimal balance between load-carrying capacity and maneuverability, which is ideal for urban and regional delivery applications. Vehicles in this range are capable of transporting substantial cargo volumes without sacrificing fuel efficiency or accessibility in congested city environments, making them popular.

The below 2 tons tonnage capacity segment is the fastest growing in the market, driven by its versatility and suitability for urban deliveries and its ability for catering to small businesses and logistics companies. They are gaining popularity, particularly for businesses that require a balance between payload capacity and maneuverability.

End Use Insights

Which end user held the largest market share?

Commercial end users held the largest market share this year. This segment relies on cargo vans for the transportation of equipment, materials and personnel across construction sites, manufacturing facilities and industrial areas. These users usually demand robust vehicles that have high payload capacities, durable construction and specialized upfitting options. Industrial fleet managers are increasingly adopting electric and hybrid cargo vans in order to comply with workplace emission standards and reduce operating costs.

The personal end user segment is witnessing the fastest growth as of this year. This is because individuals and small business owners are increasingly seeking versatile transportation solutions for personal and entrepreneurial activities. Cargo vans are increasingly being used for recreational purposes, such as camping and adventure travel, highlighting changing lifestyle trends and consumer preferences. The availability of rental and leasing options has made cargo vans more accessible to personal users, enabling flexible and cost-effective mobility solutions.

Cargo Vans Market Top Key Players

- Mercedes-Benz Group AG

- Ford Motor Company

- General Motors

- Stellantis NV

- Nissan Motor Co., Ltd. A

- Volkswagen AG

- TOYOTA MOTOR CORPORATION

Recent Developments

- In October 2025, the new KIA 2026 EV Cargo Van has launched its first preview, focusing on sustainability, flexibility and practicality. Building on the automaker’s successful Electric-Global Modular Platform (E-GMP), which is used in vehicles like the Kia EV9 and EV6, the PV5’s Electric-Global Modular Platform for Service (E-GMP.S) also uses a skateboard chassis, keeping the weight close to the ground and the cargo area open. It also features a reconfigurable body that enables modular components to be easily tacked on like LEGO blocks. As a result, the platform can be used for cargo vans, passenger vans, wheelchair-accessible vehicles, or chassis cabs.

- In October 2025, Ford Motor Co. is aiming to grab a significant share of the emerging electric vehicle market with products like the new E-Transit cargo van to match the hold it already has over the traditional internal combustion engine market. The company unveiled its new E-Transit commercial van on Thursday during a virtual webcast. The E-Transit comes in eight configurations, including three roof heights and three lengths, as well as in cargo, cutaway and chassis cab versions.

Segments Covered in the Report

By Propulsion

- ICE

- Petrol

- Diesel

- CNG

- Electric

- HEV

- BEV

- Others

By Tonnage Capacity

- Below 2 Tons

- 2 to 3 Tons

- Above 3 Tons

By End Use

- Commercial

- Personal

By Region

- North America

- Latin America

- Europe

- Asia-Pacific

- The Middle East and Africa

Invest in Our Premium Strategic Solution: https://www.towardsautomotive.com/checkout/1222

Become a Valued Research Partner with Us - Schedule a meeting: https://www.towardsautomotive.com/schedule-meeting

Request a Custom Case Study Built Around Your Goals: sales@towardsautomotive.com

About Us

Towards Automotive is a leading research and consulting firm specializing in the global automotive industry. We deliver actionable insights across key segments such as electric vehicles (EVs), autonomous driving, connected cars, automotive software, aftermarket services, and more. Our expert team supports both global enterprises and start-ups with tailored research on market trends, technology, and consumer behavior. With a focus on accuracy and innovation, we empower clients to make informed decisions and stay competitive in a rapidly evolving landscape.

Stay Connected with Towards Automotive:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards AutoTech

- Read Our Printed Chronicle: Automotive Web Wire

- Visit Towards Automotive for In-depth Market Insights: Towards Automotive

- APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

- Get ahead of the trends – follow us for exclusive insights and industry updates: Tumbler | Bloglovin | Medium | Hashnode | Pinterest

Towards Automotive Releases Its Latest Insight - Check It Out:

- United Kingdom Electric Vehicle Adhesive Market Trends, Disruptors and Competitive Strategy - https://www.towardsautomotive.com/insights/united-kingdom-electric-vehicle-adhesive-market-sizing

- Tanker Truck Market Strategic Growth, Innovation and Investment Trends - https://www.towardsautomotive.com/insights/tanker-truck-market-sizing

- India Electric Vehicle Adhesive Market Outlook Scenario Planning & Strategic Insights for 2034 - https://www.towardsautomotive.com/insights/india-electric-vehicle-adhesive-market-sizing

- E-SUVs Market Strategic Market Review, Key Business Drivers and Industry Forecast by 2034 - https://www.towardsautomotive.com/insights/e-suvs-market-sizing

- Electric Vehicle Taxi Market Size, Share and Growth Projections by 2034 - https://www.towardsautomotive.com/insights/electric-vehicle-taxi-market-sizing

- Medium Duty Truck Market Size, Share and Growth Projections - https://www.towardsautomotive.com/insights/medium-duty-truck-market-sizing

- Autonomous Boats Market Key Trends, Disruptions and Strategic Imperatives - https://www.towardsautomotive.com/insights/autonomous-boats-market-sizing

- Livestock Trailer Market Strategic Analysis & Growth Opportunities - https://www.towardsautomotive.com/insights/livestock-trailer-market-sizing

- Europe Minibus Market Competitive Landscape & Future Outlook - https://www.towardsautomotive.com/insights/europe-minibus-market-sizing

- Europe Electric Truck Market Innovation & Investment Trends - https://www.towardsautomotive.com/insights/europe-electric-truck-market-sizing

- 4-Wheel Mobility Scooters Market Trends, Disruptors and Competitive Strategy - https://www.towardsautomotive.com/insights/4-wheel-mobility-scooters-market-sizing

- Germany PP Compound for Automotive Market Trends, Disruptors and Competitive Strategy - https://www.towardsautomotive.com/insights/germany-pp-compound-for-automotive-market-sizing

- Travel Trailer Market Intelligence Report, Key Trends, Innovations and Market Dynamics - https://www.towardsautomotive.com/insights/travel-trailer-market-sizing

- Vehicle Intrusion Detection Market Intelligence, Benchmarking, Consumer Insights & Growth Strategies - https://www.towardsautomotive.com/insights/vehicle-intrusion-detection-market-sizing

- Automotive Bearing and Clutch Component Aftermarket Disruptive Trends and Future Potential - https://www.towardsautomotive.com/insights/automotive-bearing-and-clutch-component-aftermarket-sizing

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.